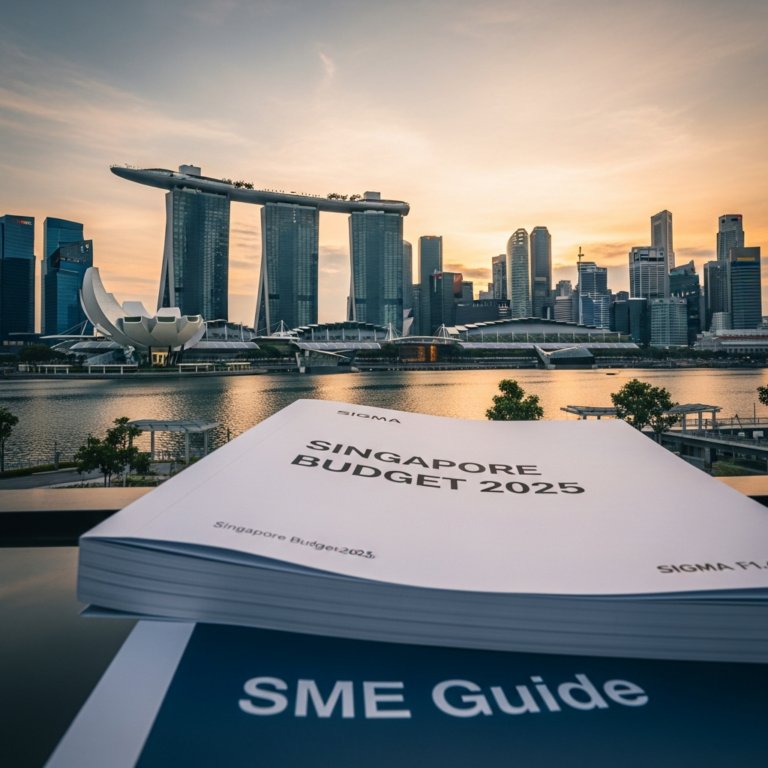

Singapore’s Budget 2025 continues to champion small and medium-sized enterprises (SMEs) by focusing on resilience, technology adoption, and workforce upskilling. With financial rebates, digital transformation incentives, and expanded SkillsFuture support, business owners have strong opportunities to strengthen operations and drive innovation. These measures align with the national effort to build a sustainable, digitally capable economy that is equipped for future growth. For SMEs, the right strategic decisions made today can result in lasting competitive advantages. Sodainmind is dedicated to helping businesses take advantage of these new initiatives to digitalise effectively and thrive in a rapidly evolving business landscape.

Enhanced Support Through Rebates and Grants

The government has introduced a range of fiscal measures to reduce cost pressures facing SMEs while encouraging reinvestment and growth.

- 50% Corporate Income Tax Rebate: SMEs will benefit from automatic relief that helps preserve cash flow and support working capital needs.

- Sector-Based Grants: Enhanced funding will target key industries such as manufacturing, professional services, and wholesale trade to drive productivity gains.

- Automation and Green Transition Incentives: Support will encourage companies to invest in energy-efficient systems and sustainable practices.

Accelerating Digital Transformation

Digitalisation remains a key pillar of Singapore’s SME development strategy. Budget 2025 introduces updated programmes that support the adoption of integrated digital solutions.

- Digitalisation Vouchers: Businesses can tap on new digitalisation credit schemes to adopt software and workflow management tools.

- InvoiceNow Integration: Companies are encouraged to implement e-invoicing for greater efficiency and compliance with digital trade standards.

- Cloud-Based Adoption: Incentives continue for businesses shifting towards secure and flexible cloud technologies.

These initiatives position enterprises to leverage data analytics, automation, and collaboration tools that streamline operations.

SkillsFuture and Workforce Development

The 2025 Budget continues to emphasise developing human capital through expanded training subsidies and reskilling initiatives. Businesses will gain from stronger workforce readiness and adaptability.

- Enhanced SkillsFuture Credits: Individuals receive new training top-ups that can be used for digital, technical, and sustainability-related courses.

- Career Conversion Support: Assistance for companies retraining staff for emerging business functions ensures continuity and growth.

- Digital Leadership Programmes: Managers and business leaders can attend government-supported courses to plan sustainable digital strategies.

Conclusion

Singapore’s Budget 2025 provides SMEs with timely incentives to advance their digital and human capital growth. By using government grants and rebates wisely, businesses can improve productivity, strengthen competitiveness, and future-proof their operations. Sodainmind stands ready to help SMEs navigate this digitalisation journey. As an approved Access Point for InvoiceNow, Sodainmind enables seamless adoption of e-invoicing and end-to-end digital business processes. If your company is planning to take full advantage of these initiatives, our team is here to support your transition. Reach out to us via info@sodainmind.com to learn how we can help you unlock the benefits of digital transformation.